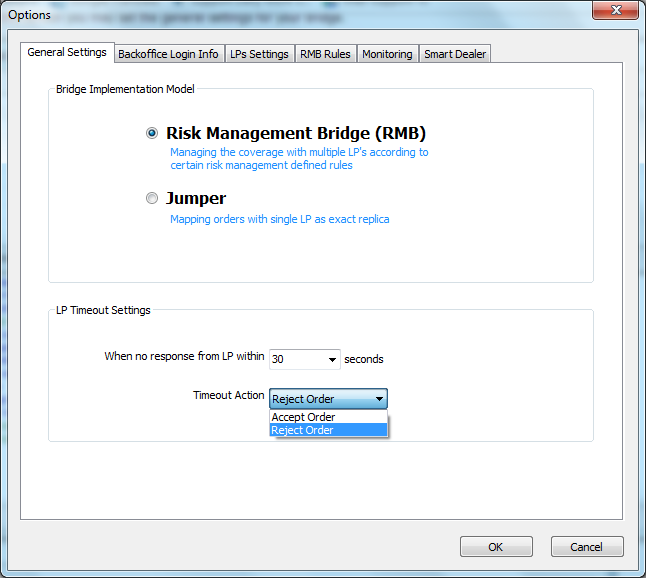

From this screen you may set the general settings for your bridge.

- Bridge Implementation Model:

VertexFX Bridge has two different models:

- Risk Management Bridge (RMB):

This model is used to manage the coverage with one or multiple LPs according to certain risk management defined rules. To edit RMB rules go to RMB Rules tab on options window. - Jumper:

This model is used to map orders with single LP as exact replica without the management rules. This option is used in the Liquidity Provider implementation model where LP has his own dealing system and he needs his VertexFX to be bundled with it as back-to-back bridging. With the Jumper mode, all incoming trades to VertexFX are exactly pushed to the other LP system after receiving acknowledgement for each order. In that mode, LP is added using the Bridge API.

Jumper (back-to-back bridging) mode performs as follows:

- Incoming Market Orders are pushed from the Vertex to the LP platform, once the market Order is approved from the LP system, Vertex will approve it to the client at the LP approved price (with slippage if been slipped)

- Limit/stop orders are not pushed to the LP side, but will be pushed once being filled in VertexFX as market orders there.Account Liquidation will be performed at VertexFX platform not at the LP side. Once account is

- liquidated, his closed positions will be pushed to the LP side as closing positions market orders.

- Bridging can be configured per account as mapping. That can be done between VertexFX and the LP platforms per account.

- LP Timeout Settings:

In this area you will be able to set what action the bridge will take after a certain seconds if there is no response from the liquidity provider side or the LP is not ready (To accept or reject the order).

See Also