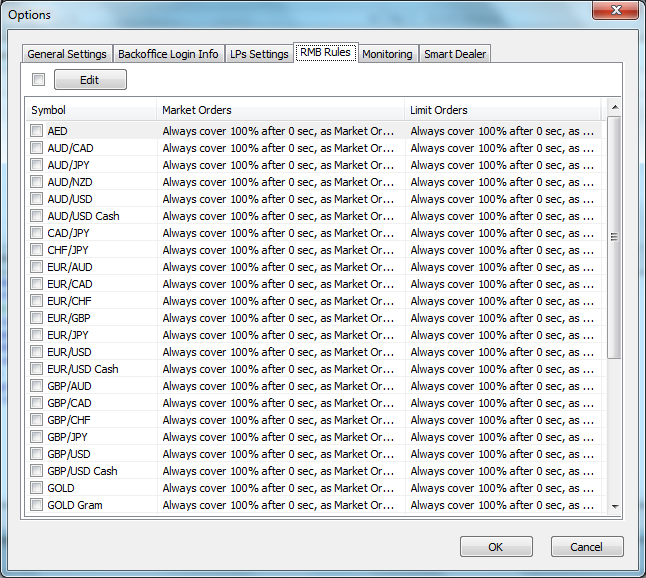

From this tab you may change the covering rules for each symbol or multiple symbols at once.

Note:

This tab will be enabled only when using the RMB model. The bridge will enable you changing RMB rules just when your BackOffice session is connected, which can be noticed in the status barwhen seeing the “Vx Bo” as green colored.![]()

After you make sure that the bridge is connected properly, tick the check box beside the desiredsymbol name, then right click and edit, or tick the check box on the top of this window to select all symbols and click edit to change the setting for the whole symbols.Then a new window will appear as the following image which contains three sections:

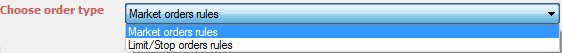

Choose order type:

- Market orders rules: Choose market orders rules to edit the covering rules for the incoming market orders.

- Limit/Stop orders rules: Choose Limit/Stop orders rules to edit the covering rules for the incoming Limit/Stop orders.

When to cover Options:

- Waiting Seconds: The bridge will delay the order for specific time, before taking an action of the order.

- Price Condition:

– Always Cover: cover the order without any price condition even if the traded symbol is not re-quotable and the order is re-quoted from the LP side.

– Cover when LP price is better by: cover the order just when the liquidity provider price reaches to a better price as the selected pips.

i.e. if you set it as 5 pips, this means that the bridge will cover with this LP just if its price is better than the order’s price of 5 pips or more.

- Always cover on liquidation: if you enable this option then the bridge will always cover the orders when your client liquidated. (This option works with market orders rules only).

How to cover Options:

- Coverage %: the amount percentage to be covered.

- Cover order as:

– Market order: To cover the orders with LP as a market orders.

– Limit order with offset: To cover the orders with LP as limit orders with the selected pips offset. - Accept order at:

– Order Price with markup: The orders will be accepted with the requested price from the clients, with markup value.

– Covered Price with markup:The orders will be accepted with the covered price from the liquidity provider, with markup value.

– Best Price with markup:The orders will be accepted with the best price between the order price and covered price, with benefit to the BackOffice side, with markup value.

See Also