We at Hybrid Solutions are happy to provide you with the latest VertexFX Bridging technology with built in currency server and all the VertexFX Risk Management Bridge previous features which can higher your risk management experience.

Introducing the VertexFX bridge currency tab with great features that can maximize your profits and lower your losses to the limit.

`

`

The VertexFX Bridge back end software is used to connect your VertexFX system to other systems for clearing and risk management purposes, you will also be able to have more options to provide your clients with best prices for you and them from different feeds.

How does it work? Lets find out

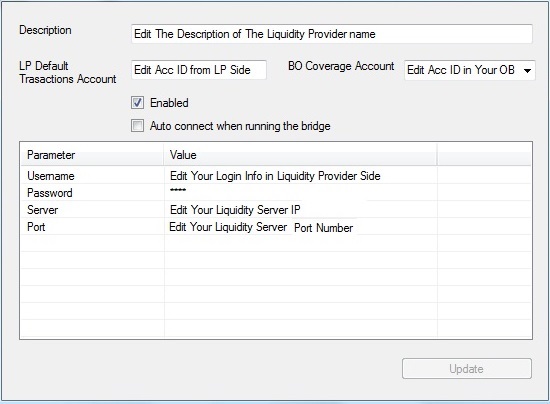

Before we start we need to add the Liquidity Provider’s and configure its settings from tools > options > Liquidity Providers Settings tab that will show on the Feeds section which we will discuss later on

After adding the Liquidity Provider we press right click and select Edit LP account information, then we start to set the required information for the Liquidity Provider like (accounts, server IP, parameters and so) as shown in the picture below

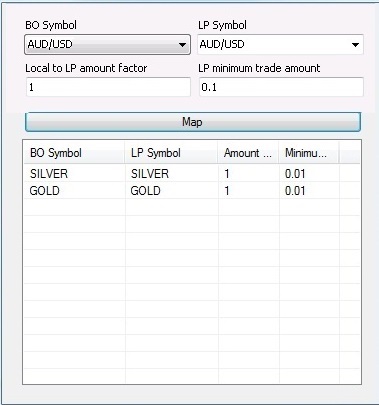

Then we will have to map symbols between your VertexFX system (BO) and LP system. This means that when the bridge receives orders for instance SILVER, from your traders, the bridge will cover them with LP as orders of the mapped symbol with this LP also the bridge will get the prices of mapped symbols from several LPS so Note that you have to map all symbols with each LP, as the bridge will reject all non-mapped symbols orders.

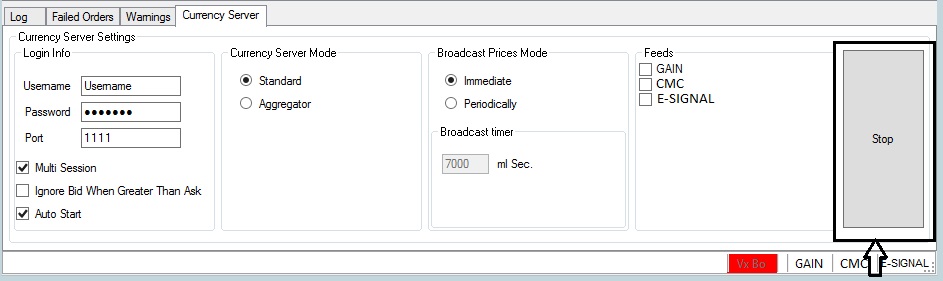

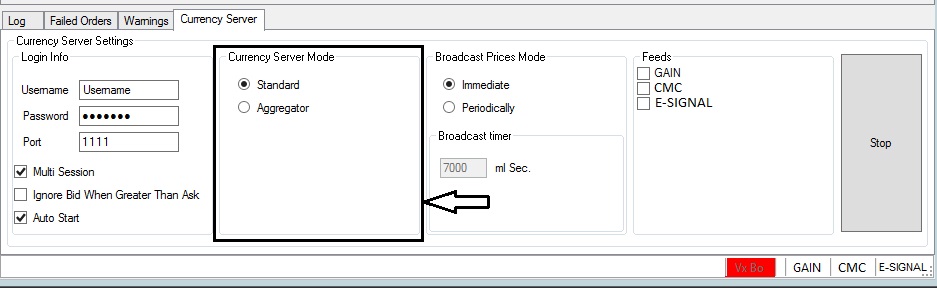

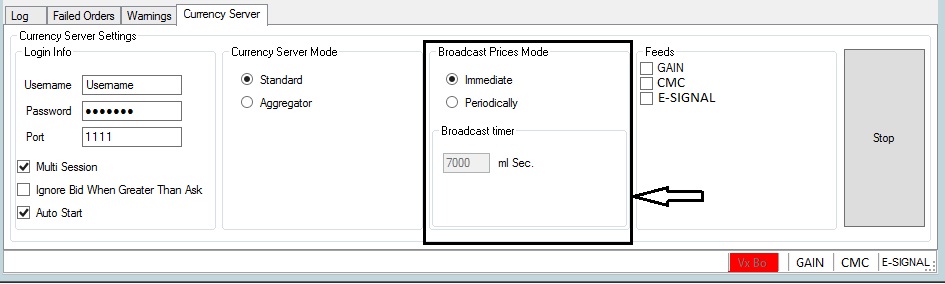

Now lets discuss the new currency server tab feature on the bridge:

– First you will need set the login information for the currency server using currency server username and password login

Also you will notice three option on the login

- The multi session option if checked it will enable multi login sessions from several VertexFX systems.

- Ignore Bid When greater than ask as it says the bid will ignored if its greater than ask which happens rarely.

- Auto start meaning it will auto login to currency when the bridge application starts.

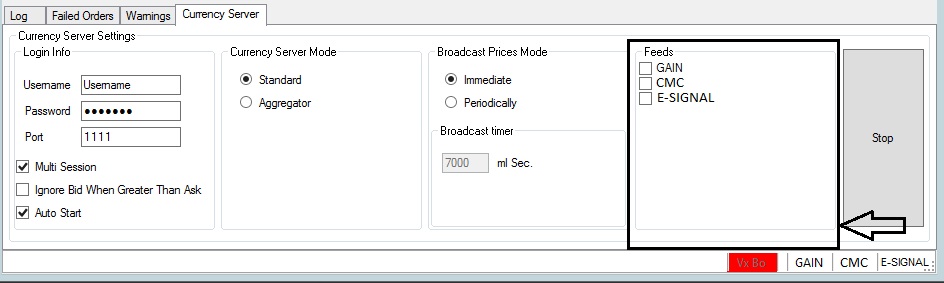

– Secondly the feeds (Liquidity Providers feed) section

Over this section as we discussed before are the Liquidity Provider we added, you will be able to select between several feeds to take prices from and cover your losses and maximize your profits, as you see its a check box meaning you can select several feeds and connect to them.

– And now the Currency server mode section

By switching between Standard and Aggregator modes you will have more flexibility over the feed

- Standared mode when chosen it will reflect all prices (ask/bid) from the selected feeds depending on the broadcast option so if you select three feeds it will broadcast three prices (ask/bid) to the clients and the clients will receive three orders.

- Aggregator mode collects prices from multiple connected online feeds after collecting the prices from the mapped symbols it will reflect the best ask price and bid price from the selected feeds according the broadcast time, if you select three feeds and for instance you sold or bought 5 lots of EUR/USD it will automatically choose the best ask and bid price from the three feeds, meaning the client will receive one price with best lowest ask and highest bid of the rates shown from the three feeds.

– The broadcast section

Within it you will be able to choose the time of symbols price rates broadcast

You can choose between Immediate and Periodically

- Immediate mode there wont be any delay the prices will reflect as fast as possible

- If you choose periodically you will be able to enter the desired time to broadcast the rates using the broadcast timer

– The stop button is to disconnect from the currency server and close all connections from it