Forex trading, also known as foreign exchange trading or currency trading, is the act of buying and selling currencies in the foreign exchange market. The foreign exchange market is a global decentralized market for the trading of currencies. This market determines the foreign exchange rate and is the largest financial market in the world, with a daily trading volume of over $5 trillion.

One of the most common strategies used in forex trading is known as fundamental analysis. This strategy involves analyzing the economic, political, and social factors that can affect the supply and demand of a currency. By using fundamental analysis, traders can make informed decisions about which currencies to buy and sell based on their understanding of the underlying forces that drive the market.

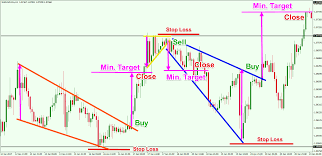

Another common strategy used in forex trading is technical analysis. This strategy involves using historical data and chart patterns to identify trends and make predictions about the future direction of a currency. Technical analysis can be used to identify entry and exit points for trades, as well as to set stop-loss and take-profit orders.

A third strategy commonly used in forex trading is called a range trading strategy. This strategy involves buying and selling a currency within a specific price range. Range trading can be a useful strategy when the market is not trending in any particular direction, as it allows traders to profit from small movements in the price of a currency.

Finally, another popular strategy used in forex trading is called a carry trade strategy. This strategy involves buying a currency with a high interest rate and selling a currency with a low interest rate. The goal of a carry trade is to earn the interest rate differential between the two currencies. This strategy can be profitable when the interest rate differential is large, but it can also be risky if the exchange rate between the two currencies changes.

In conclusion, there are many different strategies that can be used in forex trading. Some of the most common strategies include fundamental analysis, technical analysis, range trading, and carry trade. By understanding these strategies and how they work, traders can make informed decisions and potentially increase their chances of success in the forex market.

One important thing to keep in mind when using any of these strategies is that forex trading is highly risky and can result in significant losses. It is important for traders to thoroughly research and understand the market before making any trades. This can involve studying market trends, economic indicators, and political events that can affect the supply and demand of currencies.

In addition to conducting research and understanding the market, it is also important for traders to have a solid risk management plan in place. This can include setting stop-loss and take-profit orders to limit potential losses and maximize gains. It can also involve using leverage carefully, as excessive leverage can greatly increase the risk of losses.

Finally, it is important for traders to have a clear trading plan in place before entering the market. This can involve setting specific goals, such as a target profit or loss, and sticking to that plan even if the market does not move in the expected direction. By having a well-defined trading plan, traders can stay focused and disciplined, which can help them make better decisions and potentially increase their chances of success in the forex market.